Cryptocurrency calculator is a tool that helps you convert one currency into another in real time. This tool has a basic interface for converting between cryptocurrencies and fiat currencies. Using a crypto calculator, you can easily and confidently conduct quick and accurate conversions. For example, if you want to know the price of Bitcoin in USD or vice versa, the cryptocurrency calculator shows the value instantly. Now, let's tackle this widget on how to use it, the benefits of using this tool, and the factors that influence conversion rates.

How to Use PlasBit's Crypto Calculator

Here's a guide on how to use PlasBit's crypto calculator.

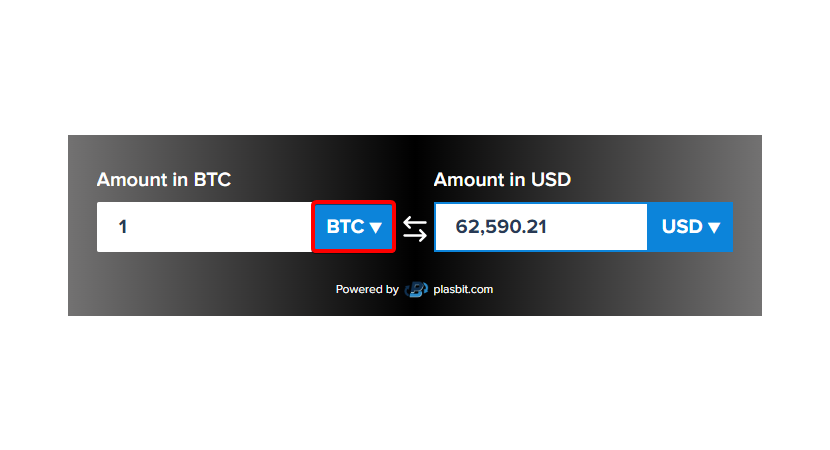

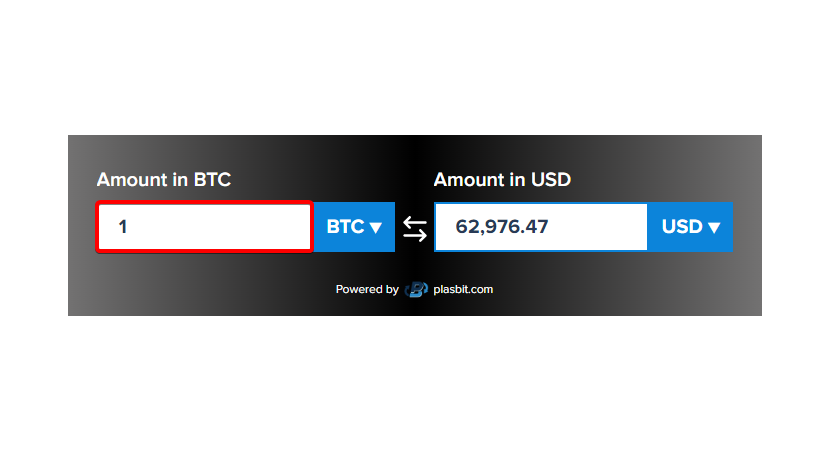

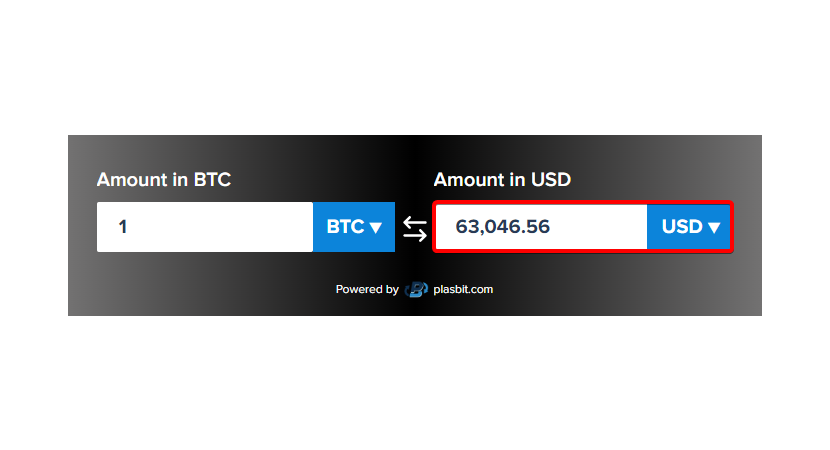

1. Start by choosing the cryptocurrency you want to calculate. Our calculator supports cryptocurrencies like Bitcoin, Ethereum, Litecoin and more. Pick the one you own or want to analyze.

2. Once you've selected your cryptocurrency, enter the amount you hold into the calculator. This step ensures the calculation of your holding's current market value.

3. After inputting your cryptocurrency amount, the calculator will instantly display the current market value of your holdings in your preferred fiat currency. This information will give you real-time insights into your investment's worth.

Benefits of Using PlasBit's Cryptocurrency Calculator

The benefits of using crypto conversion calculators in the crypto industry are huge. You can greatly enhance your involvement. Let us explore:

Risk Management:

Assessing profits and losses is an aspect and effective risk management is key. Crypto calculators allow you to evaluate different scenarios carefully, understand the risks of your assets and make good decisions. These calculators can help you examine the crypto market by analyzing various factors, identifying potential downsides and anticipating possible losses. With this knowledge, you can confidently explore the world of cryptocurrencies while safeguarding your assets against market fluctuations.

Profit Maximization:

Profit maximization is an objective for many traders in the cryptocurrency industry. Crypto calculators are tools that can assist in identifying and executing optimal strategies to achieve your goal. Whether you're involved in trading activities, tuning mining operations, or developing strong asset portfolios, these widgets serve as a guide for you toward actions that maximize profitability. By analyzing data and examining performance metrics you can discover unseen opportunities, take advantage of profitable trends and increase your profit in the crypto market. Crypto calculators provide analytical capabilities that help you in the crypto industry and open up new pathways for financial growth and success.

Educational Tool:

Education has a role in achieving success in the cryptocurrency business. With its complexity and difficulty the cryptocurrency calculator serves as a powerful educational tool for you. This widget offers a gateway to understand financial concepts specific to the crypto space. Through engagement with this calculator, you can gain practical insights into various topics such as compounding returns, risk-adjusted performance metrics and portfolio diversification principles. This experiential learning approach fosters a knowledgeable community that empowers you to make better decisions with confidence as you explore cryptocurrencies.

Time Efficiency:

Time is highly valued in the paced cryptocurrency trading and asset ecosystem. It is essential for seizing time opportunities and staying ahead of market trends. While it is important to understand equations doing manual calculations can be time-consuming and prone to errors especially when dealing with the complexities of the crypto landscape. That's where crypto calculators come in. They are tools for smart traders and users. By automating calculations and providing results these calculators relieve the burden of tedious number crunching and ensure accurate analysis. This efficiency is crucial in a paced market where every second matters. It allows you to quickly adjust your strategies take advantage of emerging trends and execute trades with confidence. By leveraging the time-saving capabilities of calculators you can optimize your workflow allocate more resources to strategic decision making and enhance your ability to navigate the crypto market effectively.

Strategic Planning:

Strategic planning is key to achieving long-term success. Whether you're creating an asset plan or making agile short-term trading decisions, strategic planning requires careful analysis and informed decision-making. Crypto calculators play a role here as they provide various analytical tools and actionable insights for strengthening your strategic planning efforts. You can develop strategies tailored to your specific goals and risk tolerance levels by simulating different scenarios evaluating risk reward profiles and optimizing asset parameters. By utilizing the capabilities of crypto calculators you can confidently navigate the complexities of the cryptocurrency landscape and position yourself for long-term prosperity in this ever-changing industry.

Portfolio Optimization:

Diversification is a principle when building a strong and high-performing asset portfolio especially in cryptocurrency. This is where crypto calculators play a role by providing sophisticated analytical tools to optimize your asset portfolios, maximizing returns while minimizing risks. By analyzing correlations between different crypto assets evaluating portfolio volatility and strategically rebalancing asset allocations, you can create well-diversified portfolios that can withstand market fluctuations. Additionally the crypto calculator enables you to continuously evaluate your portfolio's performance over time, identify areas for improvement and make adjustments to enhance overall portfolio efficiency. By leveraging these tools offered by crypto calculators you can confidently navigate the complexities of the crypto market and build portfolios that are poised for long-term success in the ever-evolving world of digital assets.

Cost Analysis:

Effective cost management is essential for achieving returns on investments. This is where crypto calculators prove invaluable as they provide analytical capabilities to thoroughly analyze and quantify various expenses associated with your activities in the cryptocurrency space.

From considering the costs associated with transactions, exchange fees and mining expenses, these calculators offer an overview of your cost structures. They help you make informed decisions to minimize unnecessary spending. By conducting cost analyses and comparing expenses across different platforms or strategies you can identify any inefficiencies and optimize your cost structures. This will maximize your profitability in the market. Taking a mindful approach to costs ensures that you retain a larger share of your profits. It also enhances your financial performance positioning you for sustained success in the dynamic and competitive world of digital assets.

Market Research:

When it comes to market research, staying up to date with trends and dynamics is crucial for making decisions. That's where crypto calculators play a role as powerful tools for conducting comprehensive market research and analysis. These calculators provide access to real-time data, historical price charts and performance metrics across crypto assets. By leveraging these tools you can identify emerging trends, assess market sentiment and implement trading strategies driven by data that capitalize on profitable opportunities. Additionally, crypto calculators allow you to evaluate the impact of external factors like regulatory changes, technological advancements and macroeconomic trends, on the landscape of the crypto market.

With these insights, you have the ability to adjust your trading strategies in real time, keep up with the latest trends and position yourself for success in the cryptocurrency industry.

What Factors Influence Conversion Rates?

The conversion rate between assets, whether traditional fiat currencies or cryptocurrencies in the financial landscape is influenced by various factors that shape market dynamics. It's crucial for traders to understand these influences in order to make decisions when it comes to asset conversion.

Supply and Demand Dynamics:

The principle of supply and demand has an impact on crypto conversion rates. When demand surpasses supply, it usually leads to an increase in crypto conversion rates indicating market value. Conversely, an oversupply can result in a decrease.

Relative Scarcity:

Relative scarcity plays a role especially in cryptocurrencies with limited or capped supplies. Limited supplies can enhance the perception of traders leading to conversion rates due to increased perceived value.

Market Sentiment:

The prevailing attitudes and emotions towards an asset, known as market sentiment can swiftly influence conversion rates. Positive sentiment often drives prices upwards while negative sentiment can result in trends. PlasBit fear and greed indicator is a tool that provides insights into cryptocurrency market sentiment offering analysis of fear and greed levels over various timeframes to help you make informed trading decisions.

Media Attention:

Media coverage such as news reports, discussions on social media platforms and endorsements from influencers can have an impact on crypto conversion rates. Positive or negative narratives can shape perception and influence trader behavior which ultimately affects conversion rates.

Regulatory Changes:

When laws or regulations that govern the asset are modified, it can have an impact on crypto conversion rates by changing how people feel about the market and their confidence as traders. To protect your assets, select platforms that adhere to regulatory standards. PlasBit is fully compliant with Polish regulations as evidenced by our crypto exchange license and registration as a company in Poland, overseen and regulated by the Ministry of Finance.

Technological Advancements:

Advancements in technology related to the asset or its underlying blockchain technology can affect conversion rates by making it more useful and valuable in people's perception.

Macroeconomic Trends:

Economic trends, like growth rates, inflation and interest rates can influence conversion rates by affecting how willing traders are to take risks and where capital flows.

Geopolitical Events:

Tensions or conflicts between countries can cause fluctuations in crypto conversion rates because they create uncertainty and change how people feel about the market.

Conclusion

Crypto calculators are valuable tools for traders and enthusiasts who want to navigate the ever-changing world of digital assets. These widgets offer precise calculations that enable you to make informed choices, effectively manage risk and maximize profits in the cryptocurrency industry. By including calculators in your toolkit, you can simplify decision-making and gain a deeper understanding of the financial principles that drive the crypto market. It's crucial to embrace these tools in order to stay ahead in the world of cryptocurrency.